French Business Cycle Dating Committee: The French Economic Association creates a committee to date France's economic cycles

Created in October 2020 by the French Economic Association (AFSE), the French Business Cycle Dating Committee aims at identifying the turning points of the French economy's business cycle and at establishing a historical chronology that will be updated.

Objectives

By proposing this dating chronology of turning points in the French business cycle from the 1970s to nowadays, the Committee aims at helping the economic analysis in multiple dimensions. In macroeconomics, such a chronology is useful for deciphering and anticipating economic fluctuations through the cycle. It is also a fundamental tool for economic forecasters to study and classify economic indicators (leading, lagging, coincident) in relation to the reference cycle. At the international level, having such a dating allows conducting world cyclical comparisons and studying cycles’ synchronization between countries. The dating chronology proposed by the Committee is also helpful for economic studies investigating the relationship between real and financial cycles to compare the two types of cycles. Having a reference chronology of turning points in the business cycle is thus a public good, extremely valuable in the toolbox of economists, especially to help the implementation of economic policies.

Definition of the business cycle

The definition of the cycle adopted by the Committee corresponds to the one used by the NBER for the United States and by the CEPR for the euro area as a whole. The cycle is defined as a succession of phases of rising activity, i.e., positive economic growth (expansions), and phases of declining activity, i.e., negative growth (recessions). These different periods are delimited by peaks (highest level of activity) and troughs (lowest level of activity), corresponding to the turning points in the cycle.

Methodology

The methodology implemented by the Committee to develop the historical chronology of turning points in the French business cycle is described in detail in this working paper. It is based on two pillars.

The first pillar is quantitative and consists of measuring the business cycle using various econometric methods, from which a list of possible dates of recessions in the French economy is obtained. The second pillar is qualitative and relies on a narrative approach based on the opinions of the experts composing this Committee (economists, conjuncturists, econometricians, historians). This so-called “experts claim” filter is essential in this type of exercise because, although quantitative methods are a valuable aid to the decision that the Committee will ultimately take, their results cannot be taken directly into account without a thorough qualitative economic analysis. The narrative approach thus makes it possible to validate, in the light of the economic situation prevailing during the episodes under consideration, the periods identified as possible recessions by the previous econometric analysis.

Recession dates in the French economy selected by the Committee

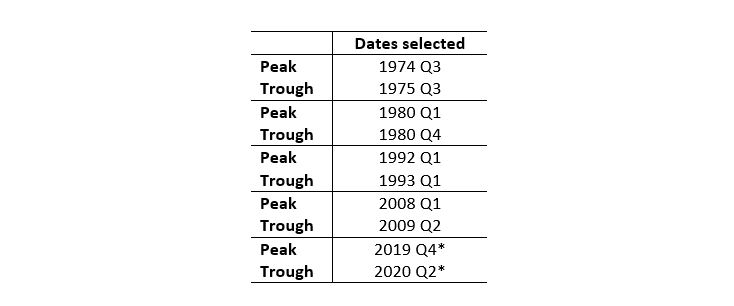

Following the application of this two-pillar methodology, the dates of the French economic recessions retained by the Committee are summarized in the table below.

Notes: (i) The date t of the peak corresponds to the end of the expansion period (i.e., the recession begins in t+1); (ii) The date t of the trough corresponds to the end of the recession period (i.e., the expansion begins in t+1). * By convention, the dates of the last recession are considered provisional.

Download the working paper

Members of the French Business Cycle Dating Committee

Laurent Ferrara, President of the French Business Cycle Dating Committee, Professor of international economics at SKEMA Business School, Member of the AFSE board of directors

Frédérique Bec, Professor at CY Cergy Paris University, Researcher at Thema and CREST-ENSAE, Member of the Haut Conseil des Finances Publiques

Emmanuel Bétry, Head of Unit - Financial Sector Economic Analysis at Direction générale du Trésor (French Treasury)

Claude Diebolt, CNRS Research Director at BETA, Former President of AFSE

Catherine Doz, Professor at the University of Paris 1 Panthéon-Sorbonne, and Paris School of Economics

Denis Ferrand, Managing Director of Rexecode, Vice-President of the Société d'Economie Politique

Eric Heyer, Director of the Analysis and Forecasting Department, OFCE, Member of the Haut Conseil des Finances Publiques

Valérie Mignon, Professor at the University of Paris Nanterre, Researcher at EconomiX-CNRS, Scientific advisor to the CEPII, President of AFSE, Member of the Cercle des économistes

Pierre-Alain Pionnier, Economist, OECD

More details can be found here: Committee.